How To Set Stop Loss On Thinkorswim

Planning Your Options Exit Strategy? Here Are Three Go out Social club Types

Larn how certain lodge types, such equally the limit order and finish club, can aid you implement your options exit strategy.

Photograph past TD Ameritrade

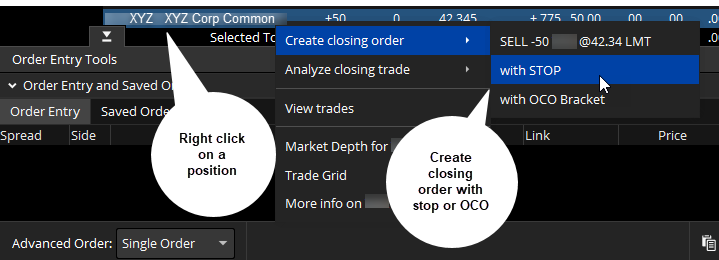

You probably know yous should have a trading plan in identify earlier entering an options trade. But what does that really mean? Here are a few ideas for creating your own trading programme, along with some gild types you can employ to implement it. Basically, a trading program is designed to predetermine your exit strategy for any trade that you lot initiate. That's pre-determine, as in, before y'all actually brand the opening merchandise. If yous make your trading program in advance, your overall arroyo is less probable to exist influenced past the market place occurrences that can, and probably volition, affect your thinking subsequently the trade is placed. In that location's no one-size-fits-all trading program, but at the very to the lowest degree, consider planning your exit points based on a sure profit target or specific loss tolerance. For example, suppose y'all bought the XYZ January 80 call for $3. You lot may desire to fix exits based on a percentage gain or loss of the trade. Using percentages instead of dollar amounts allows you to treat your trades every bit. For example, some traders will exit options trades at a 50% loss or a 100% gain. Then that's their bones program, at least on paper. Exiting with a turn a profit of 100% would mean selling the Jan 80 call for $6. If the toll were to increase to more than than $6, you'd go your original $iii back, plus $iii more, for a 100% render (minus transaction costs). Exiting the merchandise with a l% loss would mean selling the call if it drops to $ane.50, which is half of the entry price. Adjacent, y'all can place the orders that would shut out the trade co-ordinate to your programme. The turn a profit go out could utilise a basic limit order to sell the calls at $vi. The loss exit could use a cease club, which specifies a trigger toll to become active, so information technology closes your merchandise at the marketplace toll, meaning the best available price. In this example, y'all would set a stop social club at $1.fifty. Once the telephone call option drops to $1.50, the social club activates and the selection is sold at the market price. Note that a terminate order will not guarantee an execution at or near the activation price. No one knows exactly where a market club volition fill. It could fill close to $ane.fifty or very far from that toll. In one case activated, these orders compete with other incoming market orders. Y'all could place these 2 orders together using an OCO guild, which stands for "one cancels other" (come across figure 1). Once either order gets filled, the remaining club is canceled automatically. The OCO aspect is what would allow two seemingly alien closing orders to be in effect at the same fourth dimension. Effigy 1: Leave ORDER STRATEGY . To close out an existing position in thethinkorswim® platform, correct-click the ticker symbol (or anywhere on that line) to pull up your order types. Fill out the quantity and cost fields, and select Ostend and Send . For illustrative purposes only. This same logic could employ to a bearish trade on XYZ. Suppose you paid $4 for the Dec 60 puts. Y'all could attempt to shut the order at a 100% profit (minus commission costs) past placing a limit social club at $8. Or endeavour to close them with a l% loss by selling them with a stop of $2. Keep in listen that the stop gild doesn't guarantee y'all'll get the trigger price. And, again, an OCO order might exist useful for inbound both orders. Some other options social club type to consider is aabaft stop order. This is like to the regular cease order, except that the trigger cost is dynamic—it moves in the direction that you want the options price to get (encounter effigy 2). If a stock or options cost moves in your favor (the trail stop adjusts up for a long position and downwards for a curt position), the trail cease gets closer to triggering when up and down price movements have been taking place. FIGURE 2: FOLLOW THE TRAIL; FOLLOW THE Tendency . For illustrative purposes but. Past functioning does not guarantee futurity results. Let's say that with the January 80 calls, instead of using the finish lodge to cut your losses, you use aabaft finish lodge of $1.50. This means the trigger price volition be $i.50 lower than the highest price the option attains. If the choice moves up to $v, and then the trigger price will go $iii.50 ($five.00 - $ane.50). Stop orders can be used to try to lock in a profit rather than limit a 50% loss. If yous hold a position that currently shows a profit, you may place a finish order at a bespeak between the purchase cost and the electric current toll as role of your options exit strategy. These options order types work with several strategies—on the long side as well every bit the short side. As a short example, permit's say you sold a November 50 cash-secured put on XYZ for $2. On the profit side, you could enter a limit society to buy the puts for $0.05. Although you wouldn't receive 100% of your profit potential, endmost the put eliminates the risk of remaining in the trade and may gratis upward majuscule for other trades. The leave trade on the loss side could exist a stop order to buy the puts if the price rises to $3, which would leave the trade with a loss that's nigh 50%. Or you could use a $1 abaft stop order. Then if the puts dropped to $0.75, for example, the trailing trigger toll would be $1.75. These are merely a few different types of exit orders you can use, along with various order types for implementing your plan. Get trading admission at many levels, from device-optimized mobile apps to the professional person-grade thinkorswim® platform .Program Your Options Exit Strategy

Leave Gild Upward

Trail to Manage Risk or Profits?

Powerful Platforms, Powerful Tools

Showtime your email subscription

Recommended for yous

Related Videos

Source: https://tickertape.tdameritrade.com/trading/options-exit-market-limit-orders-16672

0 Response to "How To Set Stop Loss On Thinkorswim"

Post a Comment